cap and trade system vs carbon tax

Not quite yet I prefer a carbon tax over cap-and-trade but cap-and-trade over nothing Appalachian State economics professor John Whitehead wrote on the Environmental Economics blog last week. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument.

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so by treating both instru-.

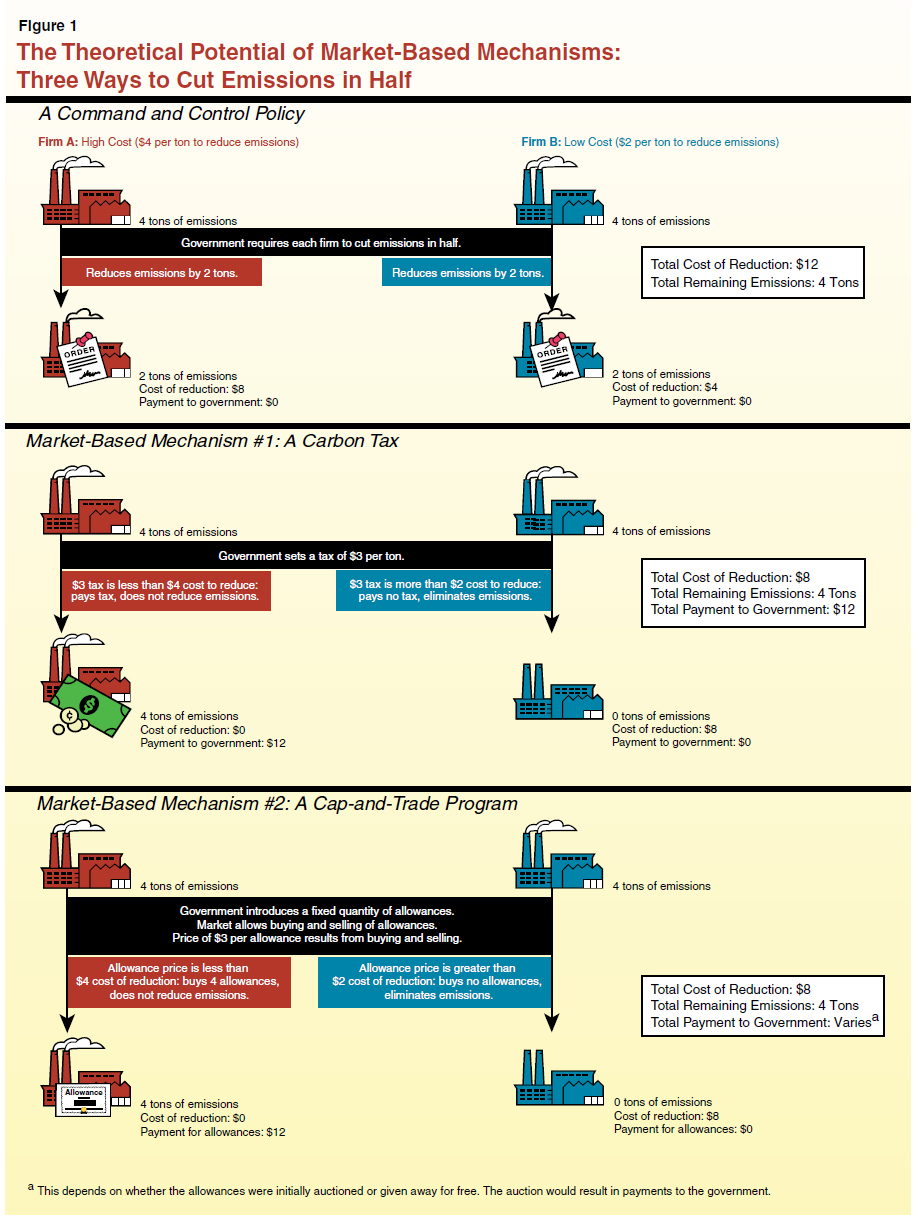

. A Carbon Tax vs Cap-and-Trade The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs. The carbon tax method is a tax on the carbon content of fuels effectively a tax on the carbon.

A key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of attractions over pure cap and trade. Theory and practice Robert N. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms.

A carbon tax and cap-and-trade are opposite sides of the same coin. Beyond helping prevent price volatility and reducing expected policy errors in the face of uncertainties exogenous pricing helps avoid problematic interactions with other climate policies and helps avoid large wealth. In contrast cap and trade levies an implicit tax on carbon.

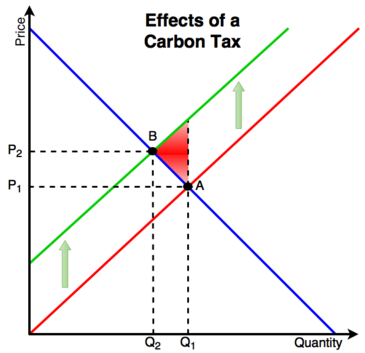

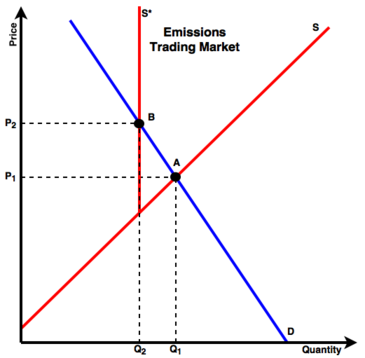

A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions.

The term cap means the limit or the maximum of the amount of pollutant to be emitted. Cap and trade is different from a straight carbon tax. Carbon tax is better on merits cap-and-traders trade away political advantages Standards-based regulations and public investment are superior to.

A Critical Review Lawrence H. Revenue vs environment. While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures.

While both carbon tax and cap-and-trade system aim at reducing greenhouse emissions they use a different approach and yield slightly different results. A carbon tax is an explicit tax and Americans are notoriously tax phobic. With a carbon tax there is an immediate cost to firms for polluting.

Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. The cap-and-trade program will start on January 1. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than paying.

However a carbon tax is easy to administer and straightforward to. Each approach has its vocal supporters. In comparison quantity is the starting point in a Cap n Trade program.

In the case of the carbon tax there is a fixed revenue as firms are expected to pay the tax on each unit of emissions while the level of pollution is determined by market forces as there is. The cap aspect is where a government sets an emission cap and issues a. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages carbon emissions but cannot limit them to quantifiable annual levels-A Carbon Tax is based almost exclusively around the nation-state level.

A trade refers to the transfer of permits that have to be bought by firms that need to increase their volume of emissions from firms that require fewer permits 1. A carbon tax doesnt discriminate between individuals and industries. Goulder and Andrew Schein NBER Working Paper No.

The government sets the amount of CO2 each producer can produce to meet benchmarks and then leaves the price up to. 19338 August 2013 JEL No. Carbon taxes vs.

Carbon Tax Pros And Cons Economics Help

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Carbon Tax Vs Emissions Trading Energy Education

Carbon Tax Vs Emissions Trading Energy Education

Explainer Which Countries Have Introduced A Carbon Tax World Economic Forum

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Difference Between Carbon Tax And Cap And Trade Difference Between

Carbon Tax Pros And Cons Economics Help

Economist S View Carbon Taxes Vs Cap And Trade

2022 Carbon Tax Rates In Europe European Countries With A Carbon Tax

Difference Between Carbon Tax And Cap And Trade Difference Between

Green Supply Chain News Summarizing Cap And Trade Versus Carbon Taxes To Deal With Co2

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

The Footprint Of Us Carbon Pricing Plans Rhodium Group

Difference Between Carbon Tax And Cap And Trade Difference Between

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Comparison Of Carbon Tax And Cap Trade Eme 803 Applied Energy Policy